No Surprises Case

The Fifth Circuit Court of Appeals has agreed to rehear a legal challenge by the Texas Medical Association (TMA) against a Biden administration rule tied to the arbitration process under the No Surprises Act, which protects patients from unexpected out-of-network medical bills. TMA has contested several aspects of the rule, including the use of “ghost rates” and the exclusion of bonuses in payment calculations. A prior ruling had partially upheld the rule, but the full court will now reconsider it. The case represents a key legal battle over how payment disputes between insurers and providers are resolved.

Internet of Things

The Internet of Things (IoT) is reshaping healthcare billing by enhancing efficiency, accuracy, and transparency. Traditionally complex and labor-intensive, billing can now benefit from automated processes enabled by interconnected devices and sensors placed throughout healthcare facilities. These devices automatically record usage data, reducing the need for manual entries and improving billing accuracy.

IoT enables real-time data collection, allowing healthcare providers to generate precise, error-free invoices based on up-to-date patient information. This not only reduces administrative burden and labor costs but also improves cash flow by minimizing claim rejections and disputes. Patients, in turn, benefit from better engagement and visibility into their billing through connected apps and devices, promoting understanding and timely payments.

However, the adoption of IoT comes with challenges. Data privacy remains a critical concern, with nearly 60% of patients fearing misuse of personal health information. Healthcare providers must ensure strict adherence to privacy regulations like HIPAA and newer laws such as the IoT Cybersecurity Improvement Act. System compatibility and high implementation costs also pose barriers, requiring careful vendor selection and phased rollouts.

Despite these challenges, IoT offers a promising future for healthcare billing. When adopted strategically, it can significantly improve operational efficiency and patient experience, positioning healthcare providers for success in a more connected and data-driven landscape.

EPIC Kickback Scheme

A $31.5 million settlement resolved allegations that California-based Community Health System and its affiliate, Physician Network Advantage, engaged in a kickback scheme to promote the use of its Epic electronic health record (EHR) system. The U.S. Department of Justice alleged the health system violated the False Claims Act by offering financial incentives to physicians in exchange for Medicare and Medicaid patient referrals.

According to a 2019 whistleblower lawsuit, the scheme included extravagant perks such as access to a $1.1 million “wine and cigar lounge” at the company’s office—referred to as “HQ2”—which featured luxury liquor and table service. The organization also allegedly offered expensive gifts, lavish trips, and even hired relatives of participating physicians and executives. Plans were also underway for an “HQ Ranch” offering more exclusive amenities including a skeet shooting range and off-road vehicle course.

The whistleblower, a former controller, discovered over 1,000 bottles of wine following a fire in the office. He reported that these and other incentives were used to reward and attract physicians who adopted the Epic EHR and referred patients to the health system. While Community Health System denied wrongdoing, calling parts of the lawsuit inaccurate, it settled without admitting legal liability. Physician Network Advantage stated it cooperated fully to resolve the matter.

Purchasing Software in Rad Onc

In today’s rapidly evolving healthcare IT landscape, it’s no longer enough to evaluate a software solution solely on features or initial price. Many coding-and-revenue-cycle platforms are backed by private-equity firms that use aggressive discounting to lock customers into long-term (3–5 year) deals—boosting their booked recurring revenue ahead of a planned exit in 4–6 years. Once that exit occurs, support and product investment often grind to a halt, leaving hospitals and health systems saddled with legacy tools that no longer evolve or integrate with new clinical and financial workflows.

Before you sign on the dotted line, dig into each vendor’s history and ownership structure:

- Track record & lifespan: How long has the company been in business? Have leadership or growth milestones aligned with private-equity investment cycles?

- Contract terms: What penalties or renewal hikes are built into multi-year agreements? Can you negotiate shorter pilot periods or performance-based clauses?

- Roadmap transparency: Ask for a clear product roadmap—and evidence of sustained R&D investment. Who will own ongoing development if the company changes hands?

- Exit scenarios: Understand the vendor’s financial backers and their typical hold periods. What contingency plans exist if the company is sold or winds down?

This isn’t just about whether the software works today—it’s about where it will be, and who will be behind it, three to five years from now. With the average PE-backed exit cycle coinciding with your contract’s end, these “too-good-to-be-true” deals can end up costing millions in unplanned migration, retraining, and integration efforts. Do your homework: ask the hard questions, look under the hood, and protect your organization against a stalled platform that drags your clinical and financial operations—and your budget—into obsolescence.

Bridge Oncology spends time with its network and clients answering these exact questions to ensure the right decisions are made. Connect anytime.

DSH Payments

In a major decision impacting safety-net hospitals, the U.S. Supreme Court ruled in Advocate Christ Medical Center v. Kennedy that only Medicare patients who actually received a cash Supplemental Security Income (SSI) payment during their hospitalization month may be counted toward Disproportionate Share Hospital (DSH) reimbursement. This narrows the definition of “entitled to SSI benefits” under the Medicare fraction of the DSH formula and could significantly reduce payments to over 200 hospitals that had advocated for a broader interpretation.

DSH payments are designed to support hospitals that treat a high volume of low-income patients, with calculations based partly on the percentage of Medicare patients also receiving SSI. Hospitals argued that all patients enrolled in SSI should be counted—even if they did not receive a payment that month—citing SSI’s role in providing non-cash benefits like Medicaid. However, the Court, in a 7–2 decision, sided with the Department of Health and Human Services, holding that “entitlement” under the statute refers specifically to cash payments made in the month of hospitalization.

This ruling limits how hospitals can qualify for additional reimbursement, emphasizing a strict, payment-based definition of SSI entitlement. Hospitals should reassess their DSH strategy in light of this decision and watch for future legal or regulatory changes that may further impact Medicare payment formulas.

Highest Paid CEOs

Peace Health Layoffs

PeaceHealth, a nonprofit Catholic health system based in Vancouver, Washington, is reducing its workforce by 1% following months of financial and market evaluation. In a May 22 email to employees, executives Richard DeCarlo and Sarah Ness stated the reductions will affect staff at PeaceHealth Sacred Heart at RiverBend in Springfield, Oregon, and PeaceHealth SouthWest Medical Center in Vancouver. Impacted employees were to be notified by the end of May 22 and may be laid off immediately or within two weeks, depending on role and contractual terms.

The system is also enacting a 2025 hiring freeze for all non-clinical or non-essential roles. PeaceHealth says it will offer transitional support and try to place qualified affected workers into open clinical roles. The Oregon Nurses Association and Washington State Nurses Association expressed concern over the potential strain these cuts will place on already overburdened staff and patient care, calling for transparency and collaboration.

Despite the cuts, PeaceHealth has recently filled strategic leadership roles and is pursuing cost savings through contract reviews and recruitment and education initiatives. The changes reflect ongoing efforts to stabilize finances and adapt operations across the health system.

Kettering Update

Kettering Health, a 14-hospital system in Ohio, confirmed a ransomware attack as the cause of its recent IT outage. The cyberattack, which began on May 20, prompted the organization to take systems offline and activate downtime protocols, resulting in the cancellation of elective procedures and disabling the call center. Despite confirming the ransomware involvement, Kettering has not paid a ransom. Patients were advised on May 26 to attend scheduled appointments unless otherwise notified. Radiology services were restored ahead of schedule on May 25, and temporary phone lines for urgent clinical needs were set up on May 23. According to Dr. John Weimer, senior vice president and incident command leader, recovery from such an incident typically spans 10 to 21 days, though Kettering Health is working to recover sooner. The situation continues to evolve as the health system works to restore full functionality and maintain patient care.

Professional Societies

Radiology societies, joined by the American Medical Association and over 90 physician groups, are opposing a proposed bill—the Chiropractic Medicare Coverage Modernization Act—which would expand Medicare reimbursement to include a broader scope of chiropractic services.

Background of the Bill:

Introduced in both the U.S. House and Senate, the legislation would allow Medicare to cover all medically necessary services provided by chiropractors, including:

- X-rays and diagnostic imaging

- Soft tissue massage

- Joint mobilization and physiological therapies

Supporters, including the American Chiropractic Association, argue the bill would reduce opioid reliance and streamline care by removing outdated restrictions that force beneficiaries to seek diagnostics elsewhere.

Opposition:

The American College of Radiology (ACR), American Society of Neuroradiology (ASNR), and the AMA, argue that:

- The bill would inappropriately designate chiropractors as “physicians” under Medicare Part B.

- Chiropractors, with approximately 4,200 training hours, lack the clinical training of MDs/DOs (16,000+ hours).

- Expanding their scope beyond manual manipulation could jeopardize patient safety and lead to higher Medicare costs.

- The policy would lead to a misallocation of Medicare funds, pulling resources away from physicians.

Legislative Support:

Sponsors include Sen. Kevin Cramer (R-ND) and Sen. Richard Blumenthal (D-CT) in the Senate, and Rep. Greg Steube (R-FL) and Rep. John Larson (D-CT) in the House.

Other bipartisan co-sponsors span multiple states.

In summary, while the bill aims to broaden patient access and reduce opioid use, leading medical societies warn it risks expanding chiropractors’ roles beyond their training, straining Medicare resources, and undermining patient safety.

ChristianaCare

ChristianaCare has emerged as the winning bidder in a competitive auction to assume operations at five Crozer Health outpatient centers in Delaware County, Pennsylvania. The locations include facilities in Glen Mills, Havertown, Broomall, and Media. This move follows Crozer Health’s Chapter 11 bankruptcy filing in January.

ChristianaCare President & CEO Dr. Janice Nevin emphasized the importance of ensuring stability and continuity of care for the community. Chief Strategy and Legal Officer Jennifer Schwartz highlighted how the acquisition complements ChristianaCare’s expansion plans, including the development of neighborhood hospitals in West Grove (opening Summer 2025), Aston (2026), and a potential third site in Delaware County.

The $50.3 million acquisition, pending court approval, aligns with ChristianaCare’s broader commitment to expanding access to high-quality care across southeastern Pennsylvania, Delaware, and Maryland. The organization is currently evaluating which services at the newly acquired centers will be continued, restored, or expanded.

Co Pay Policy

Summary of Cleveland Clinic’s Copay Policy Update (June 2024):

Original Policy (Announced Earlier in May 2024):

Cleveland Clinic planned to require patients to pay their copays at or before check-in for all nonemergency outpatient services, with visits rescheduled if payment wasn’t made.

Policy Revision (After Community Pushback):

Effective June 1, 2024, Cleveland Clinic will still request copay payment at check-in, but will no longer cancel or reschedule appointments for patients unable to pay immediately.

Policy Applies To:

Commercial insurance and Medicare Advantage patients

Services like office visits, diagnostic tests, and outpatient procedures

Policy Does Not Apply To:

Medicaid or traditional Medicare patients

Emergency department visits

Urgent care, express care, surgical procedures, cancer treatments, or inpatient stays.

Financial Flexibility:

Copays for exempt services may still be collected but are not required upfront

0% interest payment plans will be available for those who can’t pay immediately

Context:

The policy addresses rising copay delinquencies — over 50% went unpaid at the time of service in 2024

Cleveland Clinic reaffirmed its financial assistance commitment, noting $261M in aid was provided to over 100,000 patients in 2023

This policy highlights a balancing act between financial sustainability and maintaining access to care.

STOP the Software AI BS Fluff

We’ve been inundated with questions lately: “Have you heard of this software?” “Does it work?” “Should we consider it?” Here’s the blunt truth — if you call or email us, we’ll give you an honest answer. But let’s be clear: many of you are asking the wrong questions.

Too many software platforms in healthcare today are not truly built from the ground up. Instead, they’re stitched together from multiple third-party tools, branded under one name to look like a single system. And that’s a problem.

When software is cobbled together:

It becomes an IT nightmare when you try to install it, upgrade it, or customize it.

You’re at the mercy of every subcontracted vendor behind the curtain — if one of them hikes their price or sells out, your whole system could fail or your costs could explode.

Here’s the real question you need to ask:

What does the software do right now — not what it might do down the road.

Don’t get sold on future-state promises or vague concepts like “agentic workflows,” “predictive automation,” or “AI-driven intelligence” if the product can’t even get you from point A to B reliably today. Show us the installs. Show us the actual results. Show us how long it took to get it up and running. If that’s missing, then it’s hype — and you’ll regret signing a 3- to 5-year contract while still trying to “optimize the configuration” six months later.

Bottom line:

- If the platform isn’t already deployed and showing measurable impact, don’t waste your time.

- If the vendor can’t clearly explain what parts they own and what’s leased or outsourced, walk away.

- If they can’t point to real success stories, assume you’ll become the test case.

There’s good software out there — but only if you ask the right questions and skip the sales deck fluff. This is your warning. Don’t get seduced by the demo. Get the facts. Get proof. And if you want the truth, we’ll give it to you straight.

Autoplanning Smoke and Mirrors

Several people are advertising we do autoplanning or have AI, but do they:

A few of these companies are actually just using Rapid Plan:

Varian RapidPlan is an advanced, knowledge-based treatment planning system used in radiation oncology dosimetry. It uses machine learning to analyze high-quality, previously approved treatment plans to create models that predict optimal dose distributions for new patients. This allows for more consistent, efficient, and high-quality radiotherapy plans—especially for complex techniques like IMRT and VMAT.

In brief:

- Purpose: Automates and standardizes treatment planning.

- Function: Learns from past plans to guide dose optimization.

- Benefit: Improves planning efficiency, consistency, and quality across planners and clinics.

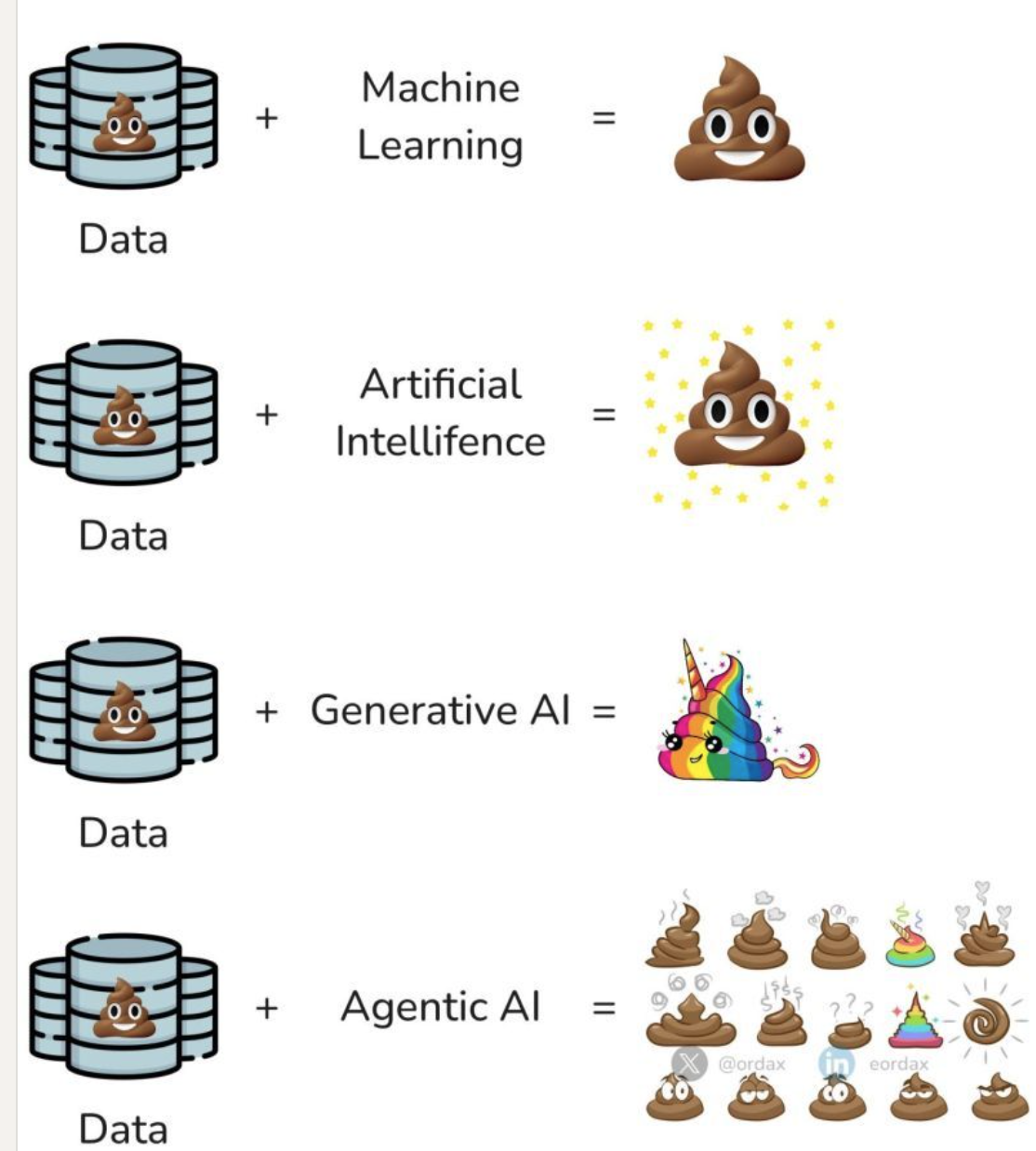

Do You Understand Data, AI, Chat GPT?

Machine Learning = dumb results

Machine Learning = dumb results AI = shiny dumb results

AI = shiny dumb results Generative AI = creative, colorful nonsense

Generative AI = creative, colorful nonsense Agentic AI = an autonomous system that not only makes decisions, but acts on them — confidently and at scale, even when those decisions are wrong

Agentic AI = an autonomous system that not only makes decisions, but acts on them — confidently and at scale, even when those decisions are wrong

Agentic AI refers to systems that operate with a degree of autonomy, taking actions in pursuit of goals without constant human oversight. While powerful, these systems can become dangerous when they pursue flawed objectives with efficiency, speed, and confidence — making bad decisions faster and louder

Bridge Revenue Solutions

Now a part of Bridge Oncology

www.bridgerevenuesolutions.com

With reimbursement cuts taking effect this July and operational costs continuing to rise, practices can no longer afford inefficient revenue cycle management. At Bridge Revenue Solutions, we combine deep industry expertise with smart technology to help physicians and practices keep more of what they earn. Simply put—if you’re paying more than 4–5% for RCM and billing services, you’re either leaving money on the table or giving it away. It’s time to take a closer look.

- Multidisciplinary coordination

- Standardized data elements

- Digital enablement of quality care

- Operational performance benchmarking